Institutional Investors

Market Makers / Brokers

Exchanges / Custodians

How the Diamond Commodity Market Works

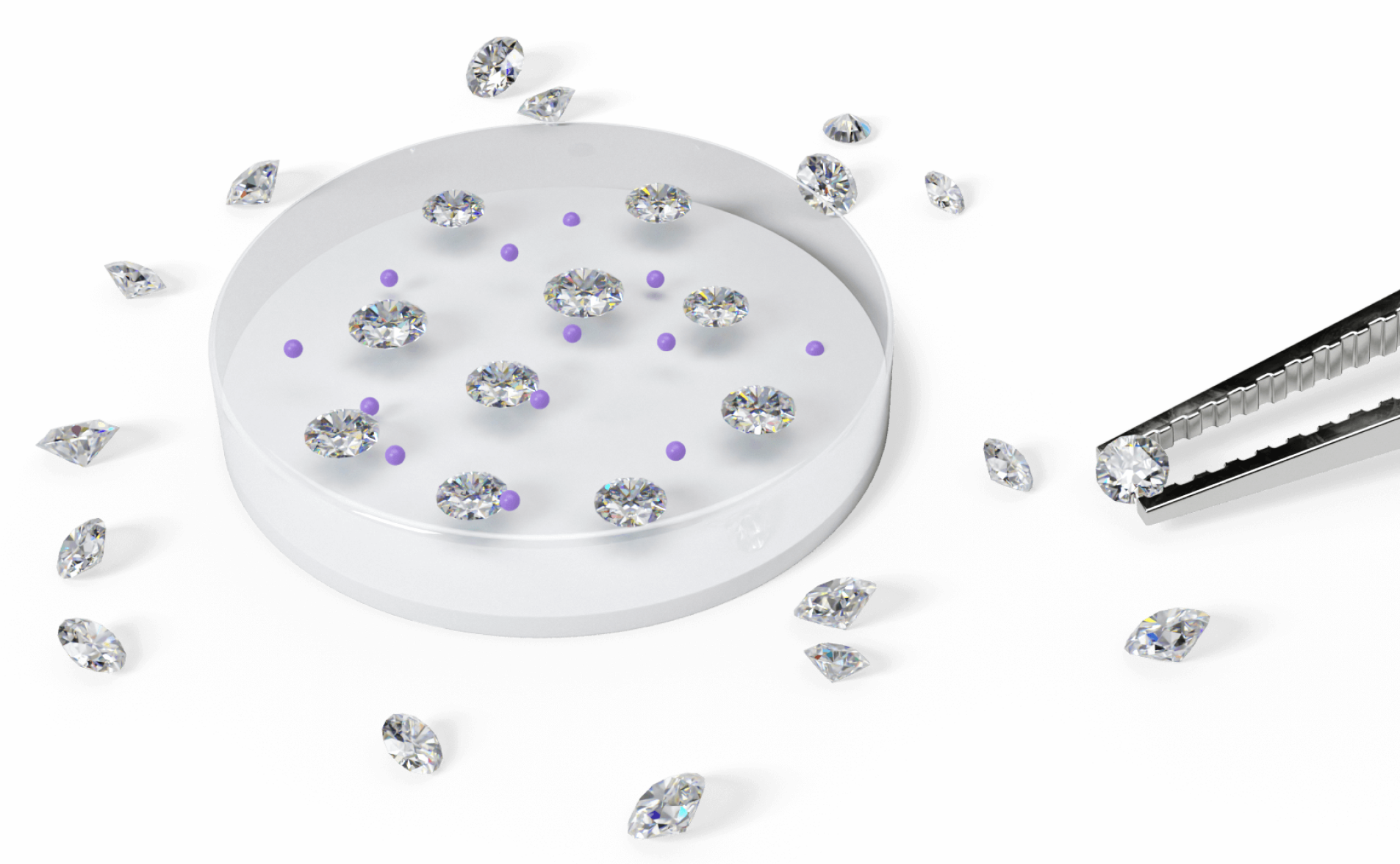

Diamond Standard is the primary dealer for diamond commodities. Like gold refiners, our job is to create and offer a fungible unit of trade. Refiners offer a kilo bar of 0.999 purity, we offer Diamond Standard Coins each containing equivalent gemological content.

As a market maker for loose diamonds, we bid on millions of diamond varieties, and force regular price discovery, by purchasing a public and statistically valid sample of diamonds. The diamond market tells us the cost.

As primary dealer, we offer new Diamond Standard Coins to consumers at a daily fix price determined by secondary market trading

We offer Coins to institutional investors via a sales desk, with pricing based on market impact, timing and volume.

Approved market makers and brokers can participate in a weekly primary dealer auction, which establishes the discount such participants require in order to provide liquidity or distribution.

We do not set the market price for the diamond commodities.

We do not participate in the secondary market (such as buying back coins, or trading on exchanges)

Primary Market

All diamonds for Diamond Standard commodities are purchased here.

The world’s only physical and digital commodity.

A private weekly auction for approved market makers and brokers, to bid on the first allocation of weekly production in minimum blocks of 100 Diamond Standard Coins. Bids are a discount from the last fix before auction. Winners pay the lowest bid that fills the allocation. The discount determined in this auction is the basis for pricing institutional sales.

Institutional investors are quoted a price relative to the last market fix and the discount determined by the prior Weekly Auction. Large orders with short delivery will be charged more for market impact. Min 200 Diamond Standard Coins.

The website retail price is the most recent market fix, determined by the VWAP on multiple spot exchanges.